child tax credit november 2021 late

Krista Swanson Gary Schnitkey Carl Zulauf and Nick Paulson Krista Swanson The US. Parents and children celebrate new monthly Child Tax Credit payments and urge congress to make them permanent outside Senator Schumers home on July 12 2021 in Brooklyn New York.

Generate Rent Receipt By Filing In The Required Details Print The Receipt Get The Receipt Stamped Signed By Landlord Sub Free Tax Filing Filing Taxes Rent

In addition to missing out on monthly Child Tax Credit payments in 2021 a failure to file in.

. Congress is debating two sets of new legislation that would impact the tax on farmer estates and inherited gains indicative of the momentum for changes to the current code for estate gifts and generation skipping taxes. Principal residence for a period of five. For purchases after November 6 2009 a reduced credit equal to the lesser of 6500 or 10 of the purchase price is allowed to an individual who owned the same US.

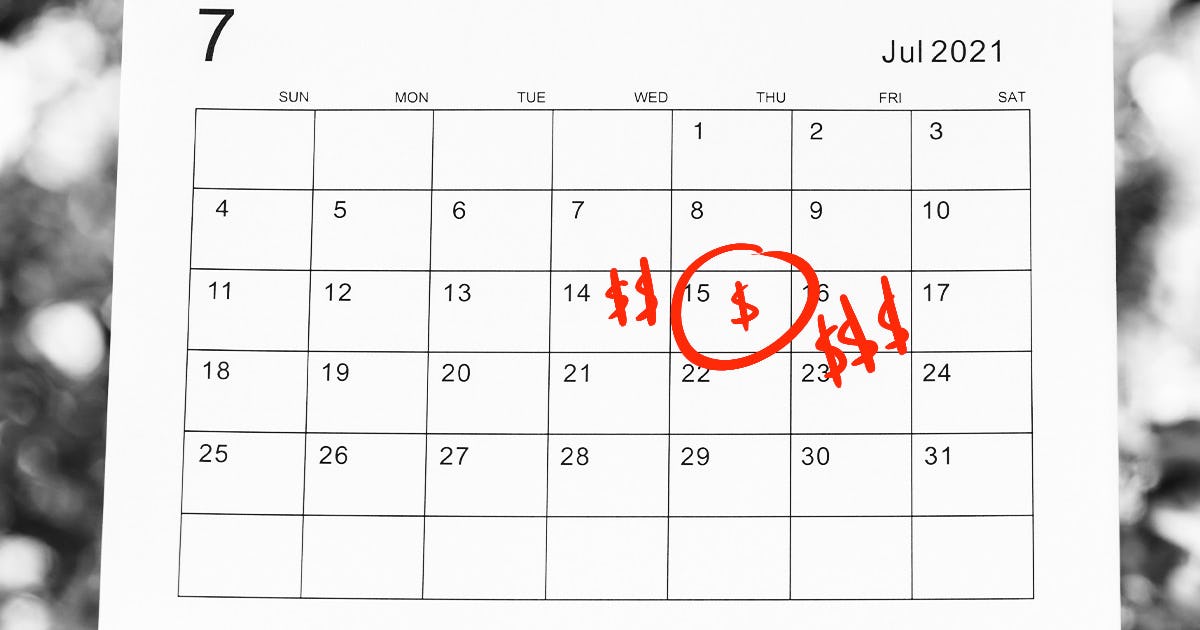

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to 1800 for each child age 5. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. The deadline to sign up for monthly Child Tax Credit payments is November 15.

For 2021 the Child Tax Credit increases to up to 3600 per child depending on age and even your 17 year old children are eligible. The federal Child Tax Credit is kicking off its first monthly cash payments on July 15 when the IRS will begin disbursing checks to eligible families with children ages 17 or younger. For a person or couple to claim one or.

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. But there is a risk any. The rest of your Child Tax Credit will be issued in one payment.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. That means a baby. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

September 2021 CPI-U was 274310 for a semi-annual increase of 356. Its not too late. IR-2022-106 Face-to-face IRS help without an appointment available during special Saturday opening on May 14 IR-2022-105 IRS provides guidance for residents of Puerto Rico to claim the Child Tax Credit IR-2022-91 Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest.

The November 2021 Budget suggested that everyone would be moved over to universal credit by 2025. Child tax credit is for those who take care of any children eligible for child benefit up to 31 August after they turn 16 or up to 20 if theyre in full-time education or registered with the careers service. March 2021 CPI-U was 264877.

Unless the expanded child tax credit is extended parents of 2022 babies will not be receiving monthly checks or the full 2021 amount of 3600. Low income adults with no children are eligible. Both pieces of legislation could have significant impacts for middle.

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file taxes this year to get the second half of your money. New inflation rate prediction. Babies born in 2022 and beyond.

The amount of EITC benefit depends on a recipients income and number of children. Not too late to claim the Child Tax. You can then compare this against a November 2021 purchase.

This also allows the opportunity to know exactly what a October 2021 savings bond purchase will yield over the next 12 months instead of just 6 months.

Child Tax Credit Payment Schedule For 2021 Here S When You Ll Get Your Money Gobankingrates

Child Tax Credit Info For Foster Parents Fpaws

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Info For Foster Parents Fpaws

Us Average Mean Bev Range All Models Evadoption Electric Car Range Range Electric Car

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

What Families Need To Know About The Ctc In 2022 Clasp

U S President Donald Trump Promotes A Newly Unveiled Republican Tax Plan On Thursday Novembe College Savings Plans Education Related 529 College Savings Plan

Gst Gaar Indirect Tax Goods And Services Income Tax

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1