when will i get my mn unemployment tax refund

As of January 27 2022 we have. On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income.

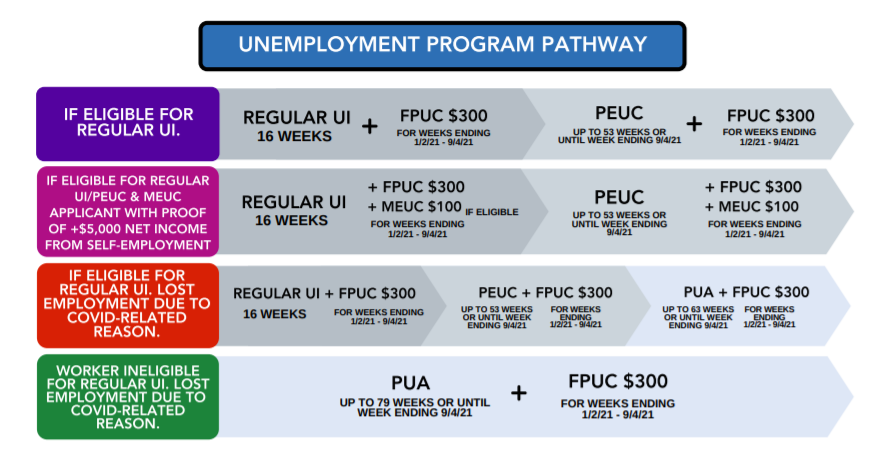

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

If you owe MN income taxes you will either have to submit a MN tax return or extension by the April 18 2022 tax deadline in order to avoid late filing penalties.

. The Minnesota Department of Revenue is issuing the checks for taxpayers who paid state tax on unemployment benefits. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G. Another way is to check your tax transcript if you have an online account with the IRS.

Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. All 2022 Unemployment Insurance Tax Rate Determinations were sent out by US.

Sadly you cant track the cash in the way you can track other tax refunds. MN Department Of Revenue Will Begin Sending Tax Refunds For PPP Loans And Extra Jobless Aid In Next Few Weeks. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. 535 on less than 27230 of taxable income. Tax refund time frames will vary.

HUNDREDS of thousands of households in Minnesota will get tax refunds worth an average of 584 each by New Years Eve. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Have you heard of the State unemployment tax bill Trust Fund Replenishment that just passed in Minnesota.

View step-by-step instructions for accessing your 1099-G. However many people have experienced refund delays due to a number of reasons. When Should I Expect My Tax Refund In 2022.

7 June 2021. Minnesota Department of Revenue set to begin processing Unemployment Insurance and Paycheck Protection Program refunds. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable.

PAUL WCCO Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. But a lot of people still.

September 30 2021 249 PM. IRS to Send More Unemployment Tax Refund Checks in July. Federal and MN State unemployment tax refund.

The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020. September 30 2021 249 PM. 2 days agoMinnesota Gov.

Everyone from doctors to janitors who worked on the pandemic front line will get 750 of hero pay and an unpopular unemployment insurance tax hike was reversed under last weeks deal at the Minnesota Legislature. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. Most should receive them within 21 days of when they file electronically if they choose direct deposit.

21 days or more since you e-filed. Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. About 667000 workers are eligible to apply for hero pay and businesses will get a credit or refund of a roughly 30 percent increase in unemployment.

We know these refunds are important to those taxpayers who have. Tax season started Jan. If you received unemployment in 2020 the federal government decided up to 10200 of that money would be tax free to help people out during the pandemic.

William Gittins WillGitt Update. If you received unemployment in 2020 youll likely get money back from the Minnesota Department of Revenue. It is too late to change your address for the 1099-G mailing but you can access your 1099-G online.

Mail to Minnesota employers on or before December 15 2021. The IRS anticipates most taxpayers will receive refunds as in past years. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13.

Requesting a refund or keeping the credit can cause issues if you dont know your payroll providers processes. We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31 2022. Minnesota Department of Revenue set to begin processing Unemployment Insurance and Paycheck Protection Program refunds.

The IRS normally releases tax refunds about 21 days after you file the returns. 24 and runs through April 18. Another way is to check your tax transcript if you have an online account with the IRS.

The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds. About 500000 Minnesotans are in line to get. 24 and runs through April 18.

If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return. Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans.

The federal tax code counts jobless benefits.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

Unemploymentrefund Twitter Search Twitter

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

State Income Tax Returns And Unemployment Compensation

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Where S My Refund Minnesota H R Block

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

When Will Irs Send Unemployment Tax Refunds 11alive Com

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc